new jersey 529 plan deduction

NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority HESAA. We break down the best options to college savings in New Jersey and what tax benefits you may receive.

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

Beginning with the 2022 Tax Year the law will allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable.

. Some states do not offer state tax deductions or tax credits for K -12 tuition and other restrictions may apply. NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for. The plan NJBEST is offered through Franklin Templeton.

In New Mexico families can deduct 100 of their contributions to New Mexicos 529 plan on their state taxes. New Jersey will offer a state tax. There are 249350 registered schools in New Jersey.

Contributions to such plans are not deductible but the money grows tax-free while it. New Jersey has a 529 Plan called NJBEST. NJBEST 529 College Savings Plan.

Managed and distributed by Franklin. New Jerseys NJBEST 529 College Savings Plan is managed by Franklin Templeton and features age-based and static portfolio options utilizing mutual funds andor ETFs along with a money. Section 529 - Qualified Tuition Plans.

New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year. A 529 plan is designed to help save for college. 529 Plan Tax Deduction.

Many states provide an income tax deduction for contributing to a college savings plan including New York which provides a maximum annual 10000 deduction. Tax Deductions for New Jersey Families Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

New York families can reduce their. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do. NJBEST New Jerseys 529 College.

Thanks to recent legislation however. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. As of December 31 2019.

New Jersey 529 Plan Statistics. Also under the New Jersey College Affordability Act if you earn 75000 or less a year you may be eligible for up to 750 given as a matching grant for amounts you have contributed. The proposed state budget includes a new state tax deduction for contributions of up to 10000 into an NJBEST account for families with incomes below 200000 state treasury.

529 Tax Benefits By State Invesco Invesco Us

Parents Do You Have The Best 529 College Savings Plan Yes You Can Choose The Washington Post

529 Tax Benefits By State Invesco Invesco Us

New Tax Breaks For Nj College Students Senior Citizens What To Know

Tax Benefits Nest Advisor 529 College Savings Plan

Kansas 529 Plans Learn The Basics Get 30 Free For College Savings

The Best 529 Plans Of 2022 Forbes Advisor

Does Your State Offer A 529 Plan Contribution Tax Deduction

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Roth Ira Or 529 Plan To Pay For College Pros And Cons Of Each

Nj Tax Treatment Of 529 Plan Earnings Njmoneyhelp Com

Yes You Really Can Pay For Private School With 529 Plans Now The New York Times

An Alternative To 529 Plan Superfunding

Tax Benefits Nest Advisor 529 College Savings Plan

State Section 529 Deductions Finaid

529 Plans The Ultimate Guide To College Savings Plans

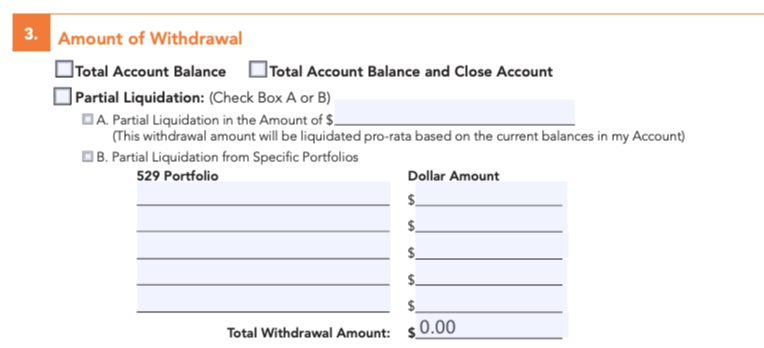

529 Plan Withdrawal Rules How To Take A Tax Free Distribution

529 Plans Which States Reward College Savers Adviser Investments